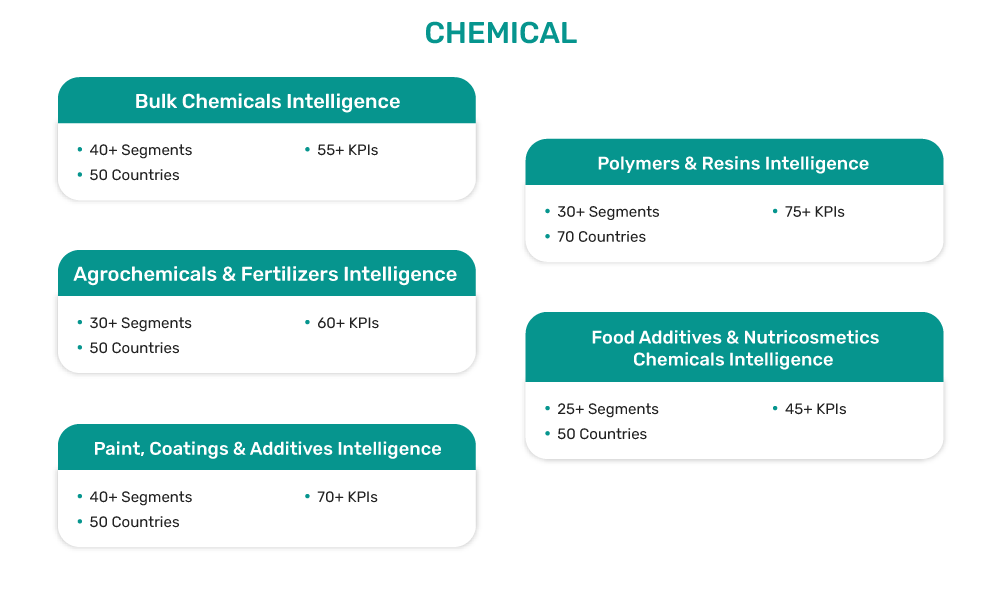

ConsTrack360’s Chemical Market Intelligence Platform analyzes strategy, innovation, and end market dynamics to help clients spot unique opportunities that directly impact revenues.

Develop strategy on the basis of a comprehensive view on chemical industry market size and growth dynamics, industry dynamics, end market spending, and competitive landscape. Our insights help companies understand business and investment opportunities along with risks in chemical industry.

Experience the power of 360° intelligence, combining best practices, emerging business models, disruptive technology, and market innovation to identify unique opportunities.

Find out more

ConsTrack360 combines industry dynamics, impact of disruptive technologies, and market innovations to offer the most comprehensive intelligence.

Leveraging a global network of analysts, we create business intelligence offerings focused on delivering accurate data and actionable insights.

ConsTrack360’s proprietary analytics platform tracks thousands of data sources to provide quantified actionable intelligence.

Track development across value chain in over 70 key economies, delivering comparable datasets for better investment and strategic decision making.

Across Europe, construction chemical manufacturers have struggled to keep up pace with the weakening global economy in 2022. The energy crisis, coupled with higher material costs, has resulted in production cuts. Furthermore, the rising inflation has also affected the demand due to a slowdown in construction activities in 2022. This has affected the volume of sales for construction chemicals firms.

However, higher prices and strong exchange rates due to the increasing US dollar, has resulted in sale figures growth for construction firms in Europe. In 2023, the construction chemical industry is projected to keep facing higher energy prices, due to the ongoing war between Russia and Ukraine. Consequently, many firms will keep contending with softening demand for their products in Europe. Furthermore, as consumers reduce their spending on home improvement, the demand is projected to remain subdued from the short to medium-term perspective.

In Asia Pacific region, higher government spending on infrastructure and affordable housing projects is expected to drive the demand for construction chemicals in 2023. The trend is projected to be particularly higher in India and China, where government institutions are infusing billions of dollars. To capitalize on the high growth potential of the Asia Pacific construction chemicals industry, firms are expanding their production capacities.

Besides scaling up capacities, construction chemicals firms are also expected to increase their investment on the sustainability front from the short to medium-term perspective. Over the next five years, the rise in urbanization and higher disposable income will also support the growth of the construction chemicals market in the Asia Pacific region. Overall, ConsTrack360 maintains a robust growth outlook for the construction chemicals market in Asia Pacific over the next three to four years.

In the Middle East as well, the growing spending on infrastructure, commercial, and residential construction projects is supporting the construction chemicals market growth. As the Emirati nation continues to diversify its economy and reduce its dependence on the oil and gas sector, the investment towards the development of infrastructure projects will keep driving the construction and construction chemicals industry over the next three to four years.

To capitalize on the high-growth potential of the United Arab Emirates construction chemicals market, ConsTrack360 expects global players to boost their presence in the Middle East market. Consequently, construction chemical makers are projected to increase their capital expenditure in the development of new plants and facilities from the short to medium-term perspective in the Emirates.

After the slowdown in construction activities in 2022, the global construction market is projected to post a growth recovery over the next 12 months, on the back of increased infrastructure spending. This will also lead to the growth of the global construction chemicals market in 2023. The global growth will be led by the construction chemicals industry in the Asia Pacific region, due to higher spending on infrastructure and housing projects in India and China.

In 2023, ConsTrack360 also expects the trend of merger and acquisition to continue in the global construction chemicals market. With firms seeking to drive their revenue growth and strengthen their position in the global market, established players are seeking potential buyout opportunities around the world. This trend will keep driving the competitive landscape in the sector from the short to medium-term perspective, thereby also supporting innovation in the sector.